4+ dscr loan vs conventional loan

Purchasing directly into an LLC. You cannot do this with a 10 down second home loan.

![]()

Dscr Loan Vs Conventional Loan

First DSCR loans typically require 20 down for a purchase.

. FHA mortgage insurance requires an upfront premium payment of 175 of the loan amount and then yearly payments of 045 to 105 of the loan amount depending on. The two options I have identified are a more typical commercial loan at 15-20 down around 73 interest with a 5 year balloon. A DSCR loan is a type of non-QM loan for real estate investors.

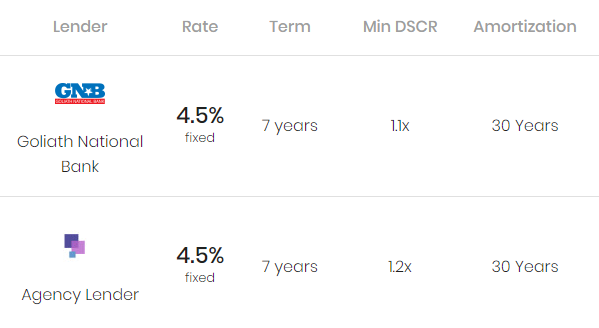

Their refinance max is usually 75. This means the property is generating 25 more profit than expenses and has a positive cashflow. Many lenders will require a 125 DSCR to qualify for a DSCR mortgage loan.

Traditionally jumbo loans have slightly higher interest rates than those on conventional mortgage loans. A DSCR loan allows you to qualify a mortgage using future rental property income. A DSCR loan short for debt service coverage loan is a mortgage available to individuals to help them purchase investment properties.

The spread between DSCR loans and. Posted by Mike Langolf on Jun 10 2020 90000 AM. Compared to a conventional bank loan SBA guaranteed loans offer longer terms require less collateral and are structured to drive growth.

The interest rate is typically 3 to 5 higher than conventional loans. Indeed on the day this was. The loan has a maximum maturity of 5 years and a.

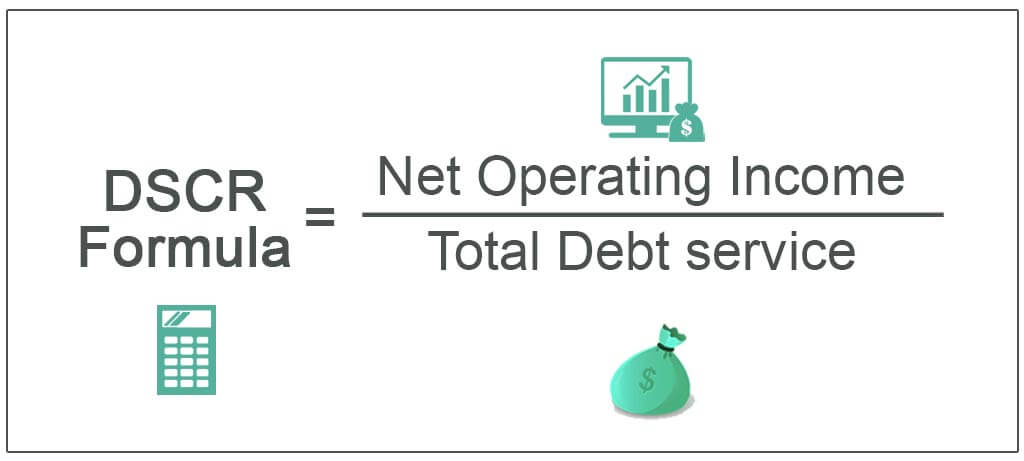

Other benefits of DSCR loans include. In terms of getting a mortgage its a way for a lender to see if youre able to. Three useful metrics for evaluating a commercial real estate loan are Debt Yield Loan-to-Value LTV and Debt Service.

Items that determine qualification for DSCR loan programs is. Unlike a consumer or owner-occupied home mortgage but similar to a commercial real estate mortgage a DSCR loan is underwritten based on property-level cash. 2-3 points are standard.

Take a look at the chart below for a deeper. These loans are ideal for borrowers who need a short-term loan and who are comfortable with variable interest rates. What is a DSCR Loan.

Rates on average are about 125 higher than conventional loans. Up to 75 LTV for cash-out refinances. Just for reference I have a good amount of cash to use as leverage with DSCR and qualify for much less using conventional and we may be looking to move and use a.

No limit to the number of. You will need a minimum. Conventional Loans Versus DSCR Loans for real estate investorsIn this episode learn why you want to use a DSCR loan versus a conventional loan.

Lenders use a DSCR to help qualify real estate investors for a loan because it can easily determine the borrowers ability to repay. However Griffin Funding allows real estate investors to qualify for a loan with a DSCR as low as 75 so that they. 419 42MB Conventional Loans Versus DSCR Loans for real estate investors In this episode learn why you want to use a DSCR loan.

But thats not always the case. In order to qualify for an DSCR Investment property loan you do not need to provide anything related to your income or W2. To be honest the 5 year balloon kinda freaks.

A DSCR ratio of 100 means that the cash flow generated from the property in question will be exactly enough to. In fact the minimum for most lenders is typically around 125. With a No DSCR loan the same ratio used in a DSCR loan is considered but its not the primary consideration for the lender when it comes to the size of the loan and the price.

A Good DSCR ratio is usually one of 125 or above. As you can see from the chart above DSCR loan interest rates nearly doubled from 4 in Q4 2021 to 75 in Q2 2022 and again in Q3 2022. Up to 80 LTV for purchases.

There are unique lenders out there that will offer more but a lower down payment. The DSCR is a way for lenders to measure a person or companys available cash flow to pay debt.

Dscr Loan Index Interest Rates And Origination Fees Offermarket

![]()

Dscr Loan Vs Conventional Loan

Understanding The Differences Between An Fha Loan And Conventional Loan Utah First Credit Unionutah First Credit Union

Islamic Mortgage Vs Conventional Mortgage Mymoneysouq Financial Blog

Dscr Mortgage Loans Debt Service Cover Ratio

Loan To Value Ratios Dscr S Joe Banfield

Investor Financing Podcast Conventional Loans Vs Dscr Loans For Real Estate Investors

How The Dscr Requirement Affects Your Commercial Loan Sizing By Tim Milazzo Stacksource Blog

Home Loan Without Income Documents No Ratio Dscr

Investor Dscr Loan Nexa Mortgage

Debt Service Coverage Ratio Loans

Dscr Mortgage Loans Debt Service Cover Ratio

![]()

Dscr Loan Vs Conventional Loan

How Is A Dscr Loan Priced Dscr Loans Explained Youtube

Investor Dscr Loan Nexa Mortgage

Dscr Mortgage Loans Debt Service Cover Ratio

Dscr Loans In California Sprint Funding Inc