Debt to income ratio calculator for heloc

What is a good debt-to-income ratio. This calculator will show you how consolidating high interest debt into one lower interest home equity loan can reduce your monthly payments.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

For a HELOC the interest rate is typically a lenders prime rate 05.

. The principle is pretty simple. A home equity line of credit HELOC can be a good option if youre looking to tap into your homes equityfor example to pay for home improvements or to consolidate debt. For your convenience we list current Redmond mortgage rates to help homebuyers estimate their monthly payments find local lenders.

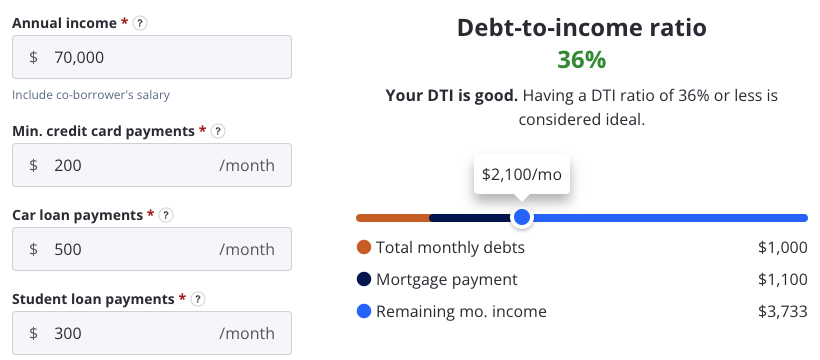

Home Equity Line Of Credit - HELOC. While it does not disqualify the borrower it will make. While a good DTI ratio should fall between 36 to 43 the lower the better.

Home equity loans usually. Another number many lenders consider before they decide you qualify for a HELOC is your debt-to-income ratio or DTI. Reduce Your Monthly Debt Payments.

Use this to figure your debt to income ratio. For example say your total monthly debt payments for a mortgage plus a car loan equals 1500 and your gross. For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk attached to an investment property or business.

The amount you spend on housing should not exceed 36 of your gross monthly pay or 28 of your gross income plus all other monthly debt payments. Your creditworthiness your debt-to-income ratio and your combined loan to value ratio or CLTV. Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal.

If youre a homeowner with strong credit and financial discipline tapping your home equity could be a good debt consolidation option for you. Therefore this is a significant increase and can be a problem for you especially if you have other debt payments or a high debt-to-income DTI ratio. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value.

A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral. Use this calculator to compute your personal debt-to-income ratio a figure as important as your credit score which provides a snapshot of your overall financial health. When you have a HELOC you may be charged a small nominal annual fee - say 50 to 100 - to keep the line open but you do not accrue.

Additional formulas to calculate rate of return on rental property. Your debt-to-income ratio is the total of all your monthly debt payments divided by your gross monthly income. If youd rather avoid manual calculations feel free to use our debt-to-income ratio calculator.

With a HELOC you can make interest-only payments significantly reducing the amount you have to pay back each month. HELOC Calculator How much home equity can you access. The calculator can show you how the payment rises and then you can determine if it is manageable.

A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. As a reminder gross income refers to the amount of money you make before deducting any withholdings from your paycheck. Your debt-to-income ratio DTI indicates the percentage of your monthly income that is committed to paying off debt.

Borrowers are pre-approved for a. Calculate Your Debt to Income Ratio. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying.

This can be helpful if you will only be able to make a repayment sometime in the future like in the case of renovating your home. Use this Debt to Equity Ratio Calculator to calculate the companys debt-to-equity ratio. Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease.

That includes debts such as credit cards auto loans mortgages home equity. The median net income on rent for landlords with any rental income positive or negative is 3783 while the median net income on rent that saw only a positive return is 6000 If your net income on rent is above 3783 your investment is most likely doing well. Whereas during the repayment period the monthly payment can jump to 330 if it is over 20 years.

Tap your home equity. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40. Debt to income ratio.

A DTI ratio higher than 43 can be seen as a sign of financial stress. Like with other.

Debt To Income Dti Ratio Calculator Money

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Debt To Income Ratio

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

Wq3z D9jhglatm

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Managing Finances Money Saving Strategies

How To Calculate Debt To Income Ratio

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Calculator Lovetoknow

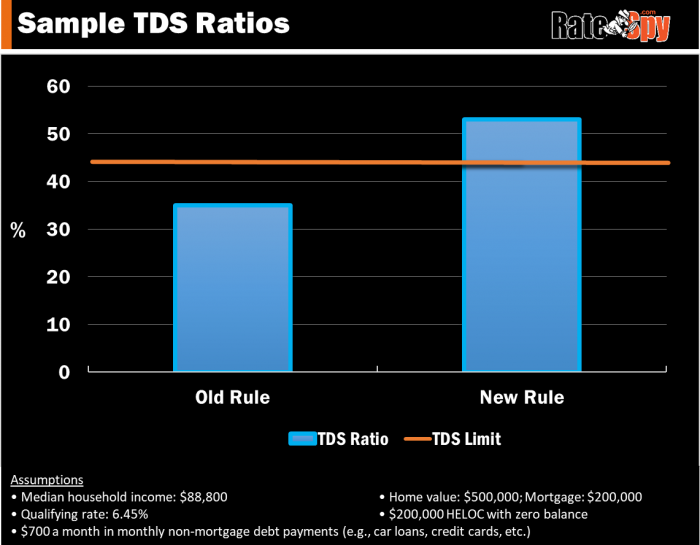

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

What Is The Debt To Income Ratio Learn More Citizens Bank

How Do Mortgage Lenders Calculate Debt To Income Ratio Youtube

Home Equity Line Of Credit Qualification Calculator

Minimum Equity Requirements For Heloc

What Is Debt To Income Ratio Dti And Why Does It Matter Nextadvisor With Time

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

What Is Debt To Income Ratio And Why Does Dti Matter Zillow